ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION IN

ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM RULES")

COMPANY NAME:

Victorian Plumbing Group plc ("Victorian Plumbing" or "the Group")

Proposed AIM TIDM: VIC

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

Registered office address:

22 Grimrod Place

Skelmersdale

WN8 9UU

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED BY AIM

RULE 26:

www.victorianplumbingplc.com

(website content and copy to be updated ahead of

Admission to fully comply with Rule 26 obligations)

COMPANY BUSINESS (INCLUDING

MAIN COUNTRY OF OPERATION) OR, IN THE

CASE OF AN

INVESTING COMPANY, DETAILS OF ITS

INVESTING POLICY). IF THE

ADMISSION IS SOUGHT AS A RESULT OF A REVERSE TAKE-OVER UNDER RULE

14, THIS SHOULD BE STATED:

Victorian Plumbing is a digitally native retailer of bathroom products and accessories,

offering a wide range of over 24,000 products to B2C and trade customers. The Group has

grown rapidly in recent years and is now, according to Mintel, the UK's leading specialist

bathroom brand and the second largest retailer of bathroom products by revenue.

Victorian Plumbing offers its customers a one-stop shop solution for the entire bathroom

with more than 125 own- and third-party brands across a wide spectrum of price points.

The Group's product design and supply chain strengths are complemented by its creative

and brand-focused marketing strategy. Its marketing activities are undertaken by a

dedicated in-house team, which predominantly focus on online channels to drive

significant and growing traffic to its website (with an average of more than 2.3 million

unique visitors per month based on the 12 months ended March 2021).

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY

RESTRICTIONS AS TO

TRANSFER OF THE SECURITIES (i.e. where known, number and type of shares,

nominal value and issue price to which it seeks admission and the number and type to be

held as treasury shares):

Number of ordinary shares of £0.001 each in nominal value ("Ordinary Shares") for which

Admission will be sought:

324,427,481

Issue price per new Ordinary Share:

262 pence

There will be no restrictions as to transfer of Ordinary Shares.

No Ordinary Shares will be held as treasury shares on Admission to AIM.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING) AND

ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

Capital to be raised on Admission:

£297,500,002

Primary to be raised on Admission: £11,600,000 / 4,427,481 shares

Secondary to be raised on Admission: £285,900,002 / 109,122,138 shares

Anticipated market capitalisation on Admission: £850,000,001

PERCENTAGE OF AIM SECURITIES

NOT IN PUBLIC HANDS AT ADMISSION:

Percentage of Ordinary Shares not in public hands on Admission:

65 per cent

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH THE AIM

SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE OR WILL BE

ADMITTED OR TRADED:

There are no other exchanges or trading platforms to which the Group has applied or

agreed to have the Ordinary Shares admitted or traded.

FULL NAMES AND FUNCTIONS OF

DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including any other name by which

each is known):

Directors:

Philip Hedley Bowcock (Chair)

Mark Andrew Radcliffe (Chief Executive Officer)

Paul Meehan (Chief Financial Officer)

Damian Robert Sanders (Senior Independent Non-Executive Director)

Kathryn ('

Kath') Louise Smith (Non-Executive Director)

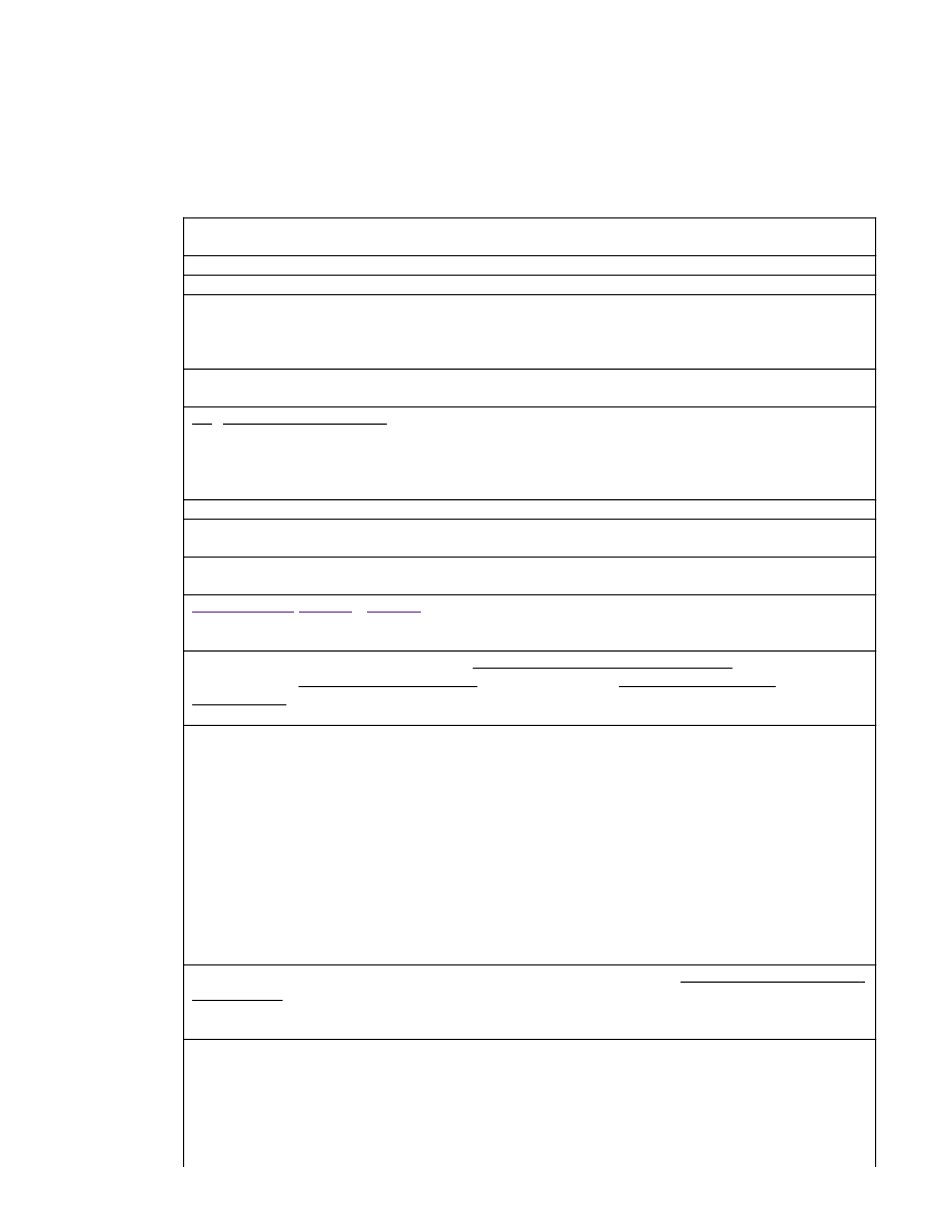

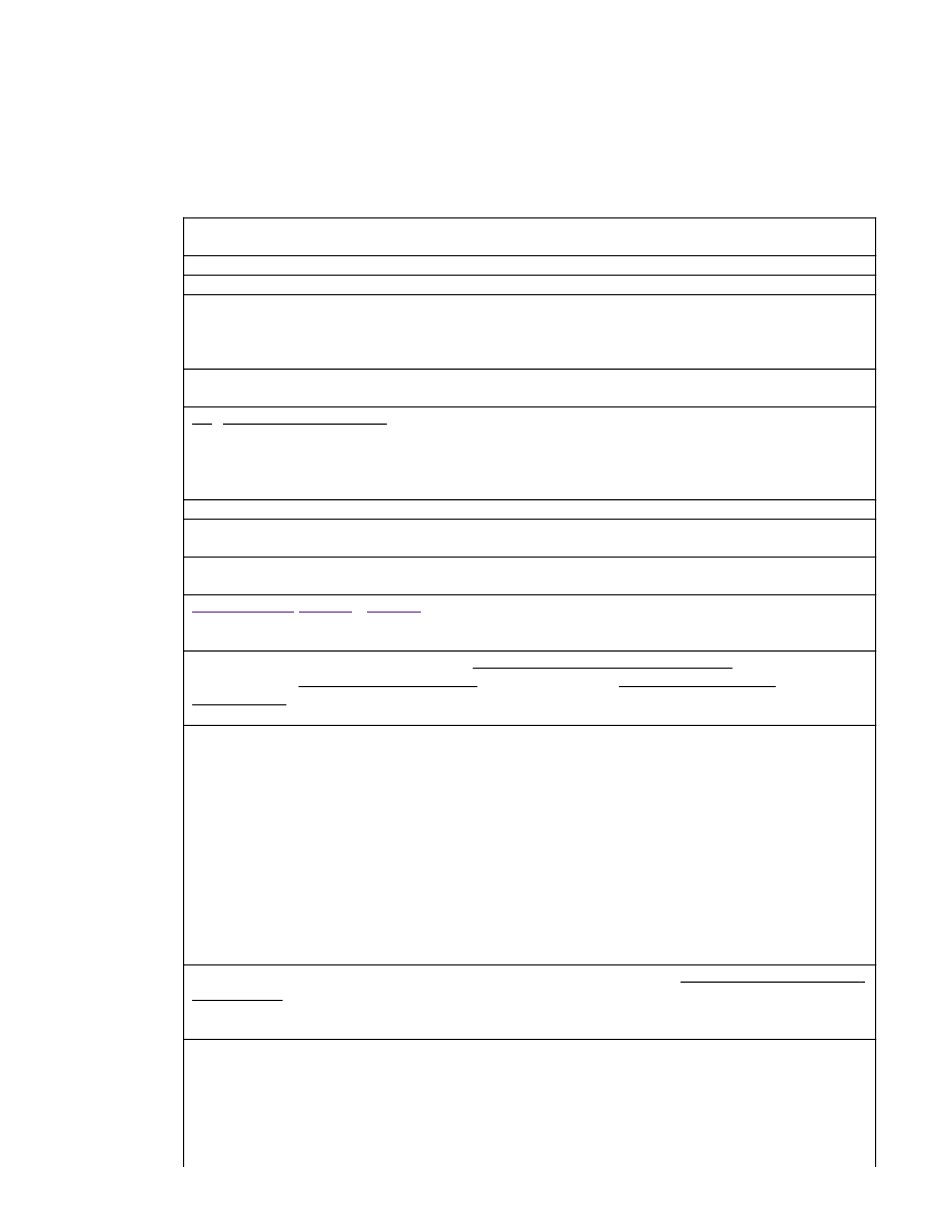

FULL NAMES AND HOLDINGS OF

SIGNIFICANT SHAREHOLDERS EXPRESSED AS A

PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER ADMISSION

(underlining the first name by which each is known or including any other name by which

each is known):

As at 17 June 2021

On Admission

Shareholder

Number of

Ordinary

Shares

% Ordinary

Shares

Number of

Ordinary

Shares

% Ordinary

Shares

Mark Andrew

Radcliffe

229,457,795

72%

148,439,833

46%

Neil George

Radcliffe

45,891,560

14%

29,688,003

9%

JPMorgan Asset

Management (UK)

Limited

n/a

n/a

16,000,000

5%

Kayne Anderson

Rudnick

Investment

Management LLC

n/a

n/a

13,000,000

4%

Carole Elaine

Radcliffe

15,297,187

5%

10,708,031

3%

Martin John

Stewart

15,297,187

5%

10,708,031

3%

TOTAL

305,943,729

96%

228,543,898

70%

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE 2,

PARAGRAPH (H) OF THE AIM RULES:

None - details of shares issued to management in the last twelve months will be included

within the Admission Document

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE

MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

i) 30 September 2021

ii) 31 March 2021

iii) 31 March 2022, 30 June 2022, 31 March 2023

EXPECTED ADMISSION DATE:

22 June 2021

NAME AND ADDRESS OF NOMINATED ADVISER:

GCA Altium Limited

1 Southampton Street

London

WC2R 0LR

NAME AND ADDRESS OF BROKER:

Barclays Bank PLC

5 The North Colonnade

Canary Wharf

London

E14 4BB

Numis Securities Limited

10 Paternoster Square

London

EC4M 7LT

OTHER THAN IN THE CASE OF A

QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL DETAILS

ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

Copies of the Group's Admission Document will be available free of charge to the public

during normal business hours on any day (Saturdays, Sundays and public holidays

excepted) at the offices of Jones Day, 21 Tudor Street, London EC4Y 0DJ, and the

registered office of the Group, 22 Grimrod Place, Skelmersdale, WN8 9UU, from the date

of the Admission Document until one month from the date of Admission in accordance with

the AIM Rules.

A copy of the Group's Admission Document will also be available on the Group's website

at www.victorianplumbingplc.com.

The Admission Document will contain full details about the Group and the admission of the

Ordinary Shares to trading on AIM.

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO APPLY

UK Corporate Governance Code

DATE OF NOTIFICATION:

17 June 2021

NEW/ UPDATE:

UPDATE